What is Debt to Income Ratio?

James Leon

08/03/2022

Financial Literacy

Businesses require money to function and expand. To get this money, they may take out loans. The debt-to-income ratio (DTI) is a metric used by lenders to determine how much debt a company can afford. It is calculated by dividing the total amount of monthly debt payments by the company’s gross monthly income.

This article will discuss everything you need to know about your debt-to-income ratio, including how it’s calculated, what factors impact it, and how you can improve your DTI.

What is the Debt to Income Ratio?

Your debt-to-income ratio (DTI) is the percentage of your monthly gross income that goes towards paying debts. Lenders use DTI to determine your ability to repay a loan. A high DTI can make it difficult to get approved for a loan and may result in higher interest rates and fees.

Lenders typically like to see a DTI of 36% or less. Some lenders may consider a DTI of up to 45%, but this is generally considered high-risk. A DTI above 50% is often considered too high to qualify for a loan.

How Does Debt to Income Ratio Work?

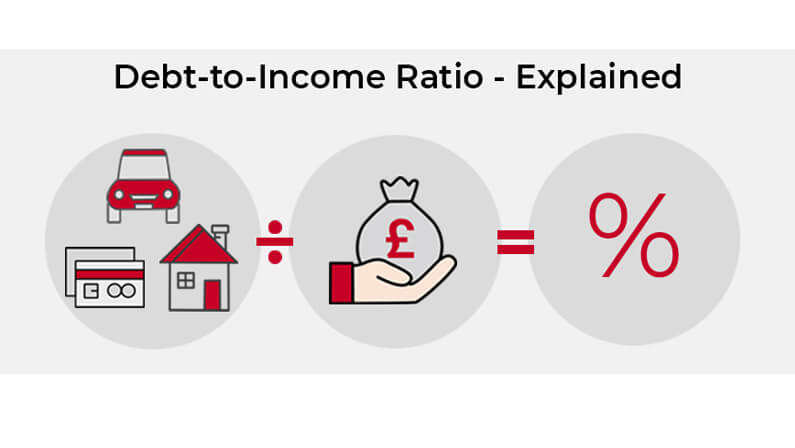

DTI works by comparing your monthly debt payments to your monthly gross income. To calculate DTI, you first need to know your total monthly debt payments. This includes all debts, such as credit cards, car loans, student loans, and any other recurring payments.

Next, you’ll need to know your gross monthly income. This is the amount of money you earn each month before taxes and other deductions are taken out.

Once you have both numbers, you can calculate your DTI by dividing your total monthly debt payments by your gross monthly income. The resulting number is expressed as a percentage.

Why is the debt-to-income ratio important?

The importance of debt to income ratio need not be overemphasized. It is one of the most important factors that lenders consider when determining whether to approve a loan. A high DTI can make it difficult to get approved for a loan and may result in higher interest rates and fees.

A low DTI, on the other hand, indicates that you have more capacity to take on new debt. This makes you a more attractive borrower and may result in lower interest rates and fees.

How to lower your debt-to-income ratio?

There are ways to lower your DTI, which may make it easier to get approved for a loan.

Some of the methods include:

- Increasing your income

- Paying off debt

- Consolidating debt

- Refinancing debt

- Debt management

How to Calculate Your Debt-to-Income Ratio

To calculate your DTI, you’ll need to know your:

- Total monthly debt payments: This includes all of your regular expenses, such as credit card payments, car loans, child support, and alimony.

- Gross monthly income: This is the total amount of income you earn in a month before taxes and other deductions are taken out.

For example, let’s say you have a monthly mortgage payment of $1,000, a car loan payment of $250, and minimum credit card payments of $50. Your total monthly debt payments would be $1,300.

If your gross monthly income is $4,000, your DTI would be 32.5%. This means that 32.5% of your income goes towards making debt payments each month.

How to Improve Your Debt-to-Income Ratio and Help Your Credit Score

Improving your DTI can also help your credit score once done right. Here are some ways to improve your DTI and help your credit score:

- Keep balances low on revolving accounts.

- Pay debts on time.

- Limit the number of new inquiries into your credit.

- Maintain a good mix of different types of credit accounts.

- Use credit counseling services if you’re having trouble managing debt.

What Is a Good Debt-to-Income Ratio?

The acceptable and average debt-to-Income ratios will differ from lender to lender. Some lenders may consider a DTI of up to 45%, but this is generally considered high-risk. A DTI above 50% is often considered too high to qualify for a loan.

What happens if my debt-to-income ratio is too high?

If your DTI is too high, you may have difficulty getting approved for a loan. You may also end up with a higher interest rate and fees if you’re approved.

What Are the Limitations of the Debt-to-Income Ratio?

One limitation of the DTI is that it doesn’t take into account the type of debt you have. For example, a DTI of 36% may be considered good if your debt is all from student loans. However, a DTI of 36% with credit card debt may be regarded as high-risk. This is because credit card debt is often considered to be more expensive and more challenging to repay than other types of debt.

How Does the Debt-to-Income Ratio Differ from the Debt-to-Limit Ratio?

The debt-to-limit ratio (DTL) is similar to the DTI, but it only considers the debts that are reported on your credit report. The DTL is often used by lenders to decide whether to increase your credit limit.

What’s Next?

Now that you know all about the debt-to-income ratio, you may be wondering what’s next. If you’re thinking about applying for a loan, make sure you understand how your DTI will affect your chances of getting approved. You can also use our DTI calculator to estimate your ratio.

You may also want to check out our guides on how to improve your debt-to-income ratio and how to lower your monthly payments. We at Centennial Funding are always here to help you make the best financial decisions for your unique situation. Give us a call today to learn more about how we can help you!

Share post:

Latest Articles

- « Previous

- 1

- 2