How to Overcome Debt Depression in Just 12 Steps

James Leon

08/25/2022

Financial Literacy

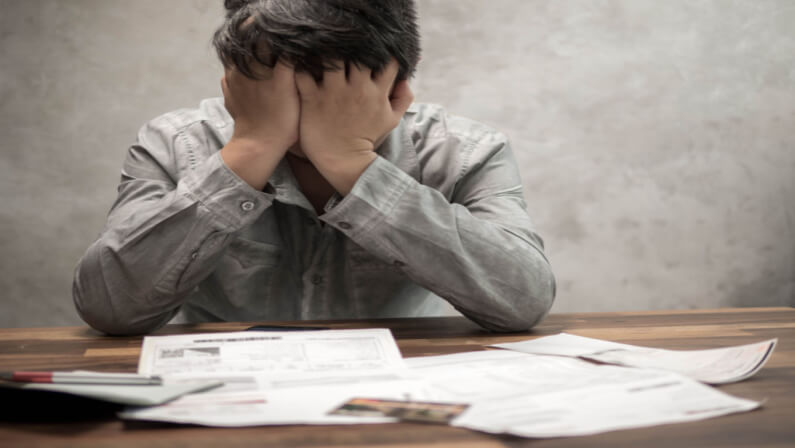

Debt depression is a serious problem that can lead to financial ruin. If you are struggling with debt, there are steps you can take to overcome it. In this article, we provide 12 steps to help you get out of debt depression.

WHO IS MOST LIKELY TO STRUGGLE WITH DEBT?

Debt is a serious problem for many people. According to experts, about 80% of Americans have debt that exceeds their incomes. This can lead to depression, anxiety, and other problems.

WHY MIGHT SOMEONE HAVE FALLEN INTO DEBT?

There are a few key factors that can make it more difficult for someone to manage their financial debt. These include: having low income, being unemployed or underemployed, and having other debts such as student loans.

Additionally, some people have a hard time sticking to a budget or dealing with stress. This makes it easier for them to spend more money than they have and then struggle to pay back their debts.

How debt can worsen depression

Debt can worsen depression in a few ways as follows:

- Owing money can make people feel constantly stressed and overwhelmed.

- High levels of debt often lead to reduced spending which can lead to even more financial stress. Because debt often comes with increased responsibilities (such as regular payments and interest payments), it can take up a lot of time and energy each month.

- Owing money can also cause people to lose hope and feel like they have no control over their lives.

- When debt is combined with other mental health issues (like anxiety or depression), it can be even harder to overcome them.

- Owing money often leads to feelings of guilt and debt shame, which can make it even harder to get out of debt and start rebuilding the life you once had.

Tips on How to Cope with Debt Depression

Debt depression can be a difficult thing to overcome, but with the right techniques, it can be manageable.

Here are some tips on how to stop worrying about debts and overcome depression:

Face your fears

When you are trying to overcome debt and depression, the worst thing that can happen is that you will be faced with the reality of your situation. The best way to address this is by facing your fears and remembering that you have made a commitment to yourself.

Set realistic goals for yourself

Don’t expect to completely clear your debt in one go – that’s just not possible. Instead, aim to chip away at the debt over time, focusing on reducing your monthly payments by small amounts until you’ve managed to bring them down to a reasonable level. This will take time and effort, but it’s worth it if you can eventually achieve financial stability.

Consider seeking support for depression

Depression is a very common problem, affecting about 4% of the world’s population. If you’re struggling to cope with debt because of poor mental health, consider talking to your GP or an independent debt counselor who can offer you advice on how best to deal with your financial situation.

Offer yourself a little grace

People can forget to pay bills on time all time, especially if they’re juggling several debts, and that’s perfectly understandable.

Stay active

If you’re struggling with debt, getting active could be the way to help yourself feel better. A healthy lifestyle can go a long way towards improving your mental health and well-being, so consider joining a local gym or going for a run.

Do not drink too much alcohol

Alcohol is known to have a negative effect on people’s moods and memories, so if you’re struggling with debt then try to avoid drinking too much.

Do not give up your daily routine

Many people who are struggling with debt give up on things such as going to work or even spending time with their friends and family, but this is a big mistake. If you want to feel better then try to carry on doing the things you love.

Take inventory of your finances

One of the best ways to start to reduce your debt is by taking a close look at all of your accounts and trying to figure out which ones are causing you the most stress.

Create a monthly budget

If you’re struggling with debt then you should try to create a monthly budget that is tailored to your specific situation. By creating a budget it will force you to see where your money is going, which will allow you to work out how best to spend the money that you do have.

Manage your overall stress

If you are feeling overwhelmed by all of your debt then it could be time to look at ways of managing your stress levels. By doing this you will be able to get back on track and start to reduce the amount that you owe.

Increase Your Income

If you are not earning enough money to cover your monthly expenses then you will need to look at ways of increasing your income. By doing this you will be able to put more money aside each month and reduce the amount that you owe.

Boost Your Financial Literacy

If you are finding it difficult to manage your money then it is likely that there are many aspects of financial literacy that you do not yet understand. By attending courses on financial literacy you will be able to boost your knowledge and find out more about how to manage your finances.

The long-term effects of debt depression

Debt depression is a term used to describe a state of mind where people feel overwhelmed and helpless when it comes to their finances. It is caused by too much debt and can last for years.

Here are some of its long-term effects:

- Insomnia. Debt depression can lead to insomnia and other sleeping problems.

- Weight gain. People who are constantly worried about their finances may gain weight as a result of overeating.

- Depression. Debt depression is a common cause of depression. In fact, debt depression is so common it is estimated that 20% of the population experience it at some point in their lives.

- Anxiety. Many people who are constantly worried about their finances suffer from debt anxiety. They may find it difficult to relax and may experience a range of physical symptoms such as headaches, stomach problems, insomnia, and irritability.

- Relationship difficulties. In relationships, people who are constantly worried about their finances can have problems with trust and communication. There is also an increased risk of divorce when couples are struggling financially.

- Social withdrawal. Many people become socially isolated due to their financial worries and they find it hard to form new relationships.

- Physical ailments. When financial worries and stress are combined with poor health, people may experience a range of physical symptoms such as headaches, stomach problems, and insomnia.

Seek Expert’s Help

Following these 12 steps can help you overcome debt depression and start living a more fulfilling and prosperous life. Remember to keep your head up, stay positive, and don’t give up on your dreams! With some effort, anything is possible.

If you are in Denver, Colorado, and in need of help in managing and consolidating your debts, don’t hesitate to contact Centennial Funding. We are here to help you get out of debt.

Share post: